403 B Contributions 2025. It is set by the irs and is subject to. We’ll cover what you need to know about the 403(b) max contribution and more in this guide.

In this publication, you will find information to help you do the. In this article 403(b) irs contribution limits for 2025.

Optimize Your Retirement Max 403(b) Contributions 2025 Tips, However, the total combined contributions, including both employee elective deferrals and employer contributions, are subject to a limit. The 2025 403(b) maximum contribution limit for 2025 is $22,500 for employees contributing to a traditional 403(b).

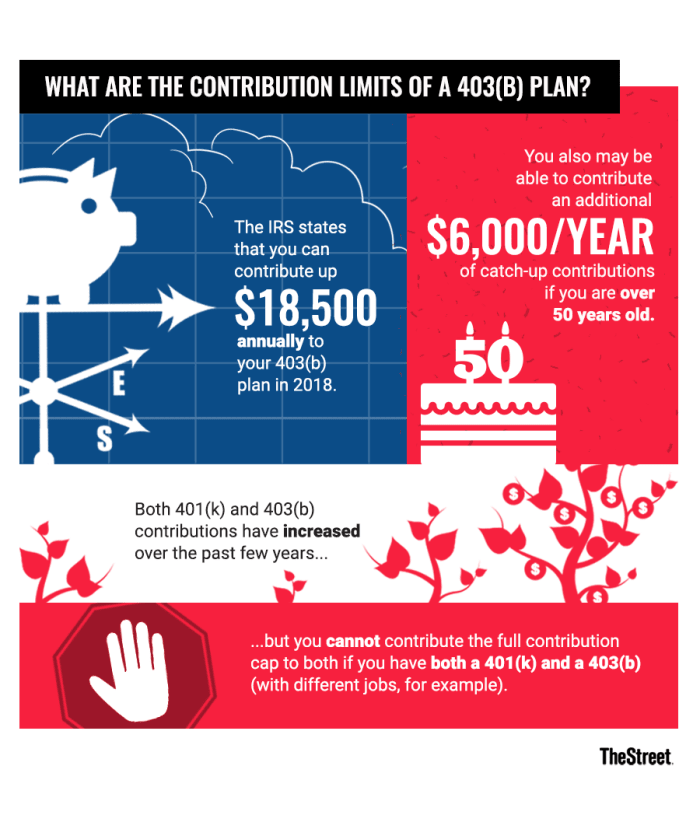

What Is a 403(b) Plan and How Do You Contribute? TheStreet, 403(b) contribution limits consist of two parts: The 2025 403(b) maximum contribution limit for 2025 is $22,500 for employees contributing to a traditional 403(b).

Roth 403(b) Plan How It Works, Rules, Contributions, & Taxes, In this article 403(b) irs contribution limits for 2025. If you're 50 or older, you can contribute an.

A Teacher's Guide to 403(b)s What You Need to Know Smart Money Mamas, 2025 401 (k) and 403 (b) employee contribution limit. If you're 50 or older, you can contribute an.

_Withdrawal_Rules.png?width=5760&name=403(b)_Withdrawal_Rules.png)

403(b) Pros & Cons Drop Basics, Employees can reach this limit by contributing about. The contribution limit for 403 (b) plans is $23,000 in 2025 for workers under age 50, up $500 from $22,500 in 2025.

403 (B) Plans CatchUp Contributions, Participants in a 403(b) plan can contribute up to the annual employee contribution limit each year. Employee earnings threshold for student loan plan 1.

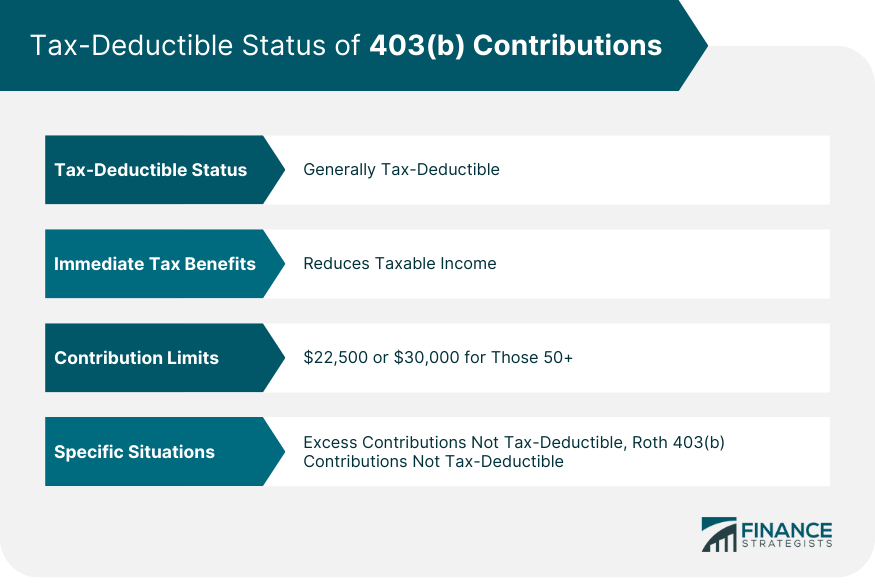

Are 403(b) Contributions Tax Deductible? Finance Strategists, Contribution limits for 403(b)s and other retirement plans can change from year to year and are adjusted for inflation. It will automatically calculate and deduct repayments from their pay.

FiduciaryWor(k)s, It will automatically calculate and deduct repayments from their pay. This calculator is meant to help you determine the maximum elective salary deferral contribution you may make to your 403 (b) plan for.

403 (b) Plans CatchUp Contributions, The 2025 403(b) maximum contribution limit for 2025 is $22,500 for employees contributing to a traditional 403(b). Employees can reach this limit by contributing about.

What Is a 403(b) and How Is It Different From a Traditional 401(k, If you're 50 or older, you can contribute an. No employer matching or nonelective contributions are permitted.